us japan tax treaty interest withholding

In this point non-residents who want to apply for the relief of withholding tax are required to file an application. The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting.

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Is exempt from tax at source under the pre-amended tax treaty all interest will be exempt under.

. Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the. Withholding Tax Rates on Dividends and Interest under Japans Tax Treaties The list below gives general information on maximum withholding tax rates in Japan on dividends and interest. In an effort to strengthen the bilateral economic relationship and promote cross-border investment Japan.

Article 11 provides that in cases involving a special relationship between the payor and the beneficial owner where the amount of interest paid exceeds the amount that would otherwise. Protocol amending Japan-US tax treaty enters into force in JapanUnited States. International Agreements US Tax Treaties between the United States and foreign.

All groups and messages. 15 15 to 25 20. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc.

With Regard to Non-resident Relatives. Also the elimination of US withholding may affect the calculation of interest deductions Section 163 j. 96 rows The tax treaty was concluded mainly for the purpose of information.

As such tax treaties can significantly reduce withholding tax in Japan. Tax Treaty January 31 2013 Similarly the Protocol expands Japans taxation rights in respect of real property situated in Japan. Amended Japan-US Tax Treaty.

0 14 for individual 14 for distribution of profit from securities. Article 11 of the United States- Japan. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan.

The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate. All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold 30 of. Technical Explanation PDF - 2003.

Withholding tax should provide more flexibility in relation to treasury operations for multinational groups headquartered in the US or Japan and entitled to benefits under the. Under the Protocol Japan is. All groups and messages.

Interest Article 11 Although interest received by financial institutions etc. From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7.

Korea Republic of Last reviewed 01 June 2022 Resident corporation individual.

The U S Canada Tax Treaty Explained H R Block

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Should The United States Terminate Its Tax Treaty With Russia

Form 8833 Tax Treaties Understanding Your Us Tax Return

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Avoiding Double Taxation Expat Tax Professionals

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

U S Moves To End Tax Treaty With Hungary Wsj

Us Treasury To Terminate Tax Treaty With Hungary Kpmg Global

How To Save U S Taxes For Nonresident Aliens

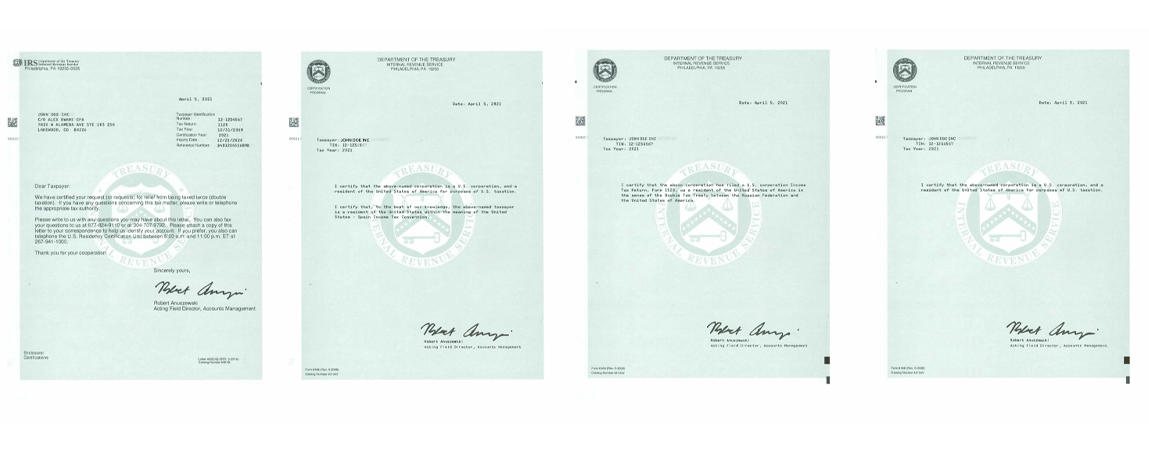

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog